These systems must also comply with tax regulations and electronic invoicing requirements, as well as support integration with health insurance providers. Relying on manual processes or outdated systems is no longer sufficient particularly for pharmacies dealing with health insurance claims or aiming to align their invoicing with government tax authorities. This is where an accounting system compatible with insurance and e-invoicing becomes an essential strategic tool to enhance efficiency, reduce errors, and ensure regulatory compliance. This article will cover:

-

Why pharmacies need an integrated accounting system

-

Key requirements of an accounting system compatible with insurance and e-invoicing

-

Common challenges faced by pharmacies during implementation

-

Benefits pharmacies can gain from using such a system

-

Why a specialized pharmacy management platform like Juleb can be a powerful solution

1. Why Pharmacies Need an Accounting System Compatible with Insurance and E-Invoicing

There are several compelling reasons for pharmacies to adopt such systems:

Legal and Regulatory Compliance

In many countries, electronic invoicing is now mandatory for all businesses, including pharmacies. Paper invoices are no longer accepted by tax authorities, and companies are expected to generate and submit electronic invoices that meet official standards.

Additionally, pharmacies working with health insurance providers must transmit detailed, compliant claim data. Claims not meeting the required format or standards may be rejected, delaying reimbursements.

Reduce Manual Errors and Speed Up Processes

Traditional manual systems increase the risk of data entry errors, lost invoices, or delays in submitting insurance claims. A fully integrated accounting system that connects point of sale, inventory, and finance reduces such errors and saves valuable time.

Accurate Financial Oversight and Management

An integrated accounting system allows pharmacies to track revenue and expenses accurately, analyze profitability per product or category, manage cash flow, and detect any financial irregularities early.

Enhanced Competitiveness and Professional Service

Pharmacies that use modern technology gain a competitive edge. Health insurance companies and customers prefer dealing with pharmacies that demonstrate professionalism through reliable and compliant systems.

2. Key Requirements for an Accounting System Compatible with Insurance and E-Invoicing

To be effective, the system must meet several technical, legal, and operational requirements:

Legal and Technical Requirements

- Compliance with E-Invoicing Regulations

The system must support invoice formats that match the country's tax authority standards including required fields, digital signatures, and real-time transmission to government portals.

- Integration with Health Insurance Systems

The system should allow for automated submission and reception of insurance claims, eligibility checks, coverage confirmations, and reconciliations with payments.

- Point-of-Sale, Inventory, and Accounting Integration

Sales transactions must automatically update accounting records and inventory levels, eliminating the need for duplicate entries.

- Multi-Branch Support

For pharmacy chains with multiple branches, the system should provide centralized control and unified reporting.

- Offline Capability

The system should function even during internet outages, with the ability to sync data later once the connection is restored.

- Security and Data Integrity

The system must include data encryption, user access control, regular backups, audit logs, and protection against fraud or unauthorized changes.

Pharmacy-Specific Functional Requirements

- Inventory Management

The system should track medications using barcodes, expiration dates, and quantity alerts, ensuring efficient restocking and inventory turnover.

- Prescription and Insurance Management

Support for entering and processing prescriptions, validating insurance eligibility, managing claims, and linking patient data to insurance coverage.

- Multi-Type Invoicing

Support for different types of invoices such as cash, insurance, purchase, and return invoices each formatted to comply with VAT or other local tax rules.

- General Accounting

Automation of journal entries, generation of financial statements (balance sheet, income statement, cash flow), and cost center management if needed.

- Advanced Reporting and Analytics

Customizable reports on sales, profit margins, inventory turnover, rejected insurance claims, and overall business performance.

- Alerts and Notifications

Real-time alerts on low stock, upcoming expirations, rejected claims, overdue payments, or financial irregularities.

3. Challenges Pharmacies Face in Implementing Such Systems

Despite the clear advantages, pharmacies often face several challenges when transitioning to these systems:

Resistance to Change

Staff used to manual processes or older systems may find it difficult to adapt to new technology, requiring proper training and onboarding.

Diverse Insurance Requirements

Each insurance company may require a different claim format or data fields, which complicates system configuration and may lead to claim rejections if not handled properly.

Technical Infrastructure Gaps

Some pharmacies may need to upgrade their hardware, internet connectivity, or internal networks to support such systems.

Data Quality and Migration

Transitioning from legacy systems requires careful migration of data. Inaccurate, duplicate, or incomplete data can lead to major issues.

Cost of Implementation and Maintenance

Pharmacies need to consider the cost of licensing, training, support, system updates, and integration with external platforms.

Regulatory Changes

E-invoicing and insurance claim regulations may evolve, so the system must be adaptable and regularly updated to reflect the latest compliance standards.

4. Benefits Pharmacies Can Gain from Adopting a Compatible Accounting System

When implemented properly, the system offers numerous impactful benefits:

Increased Operational Efficiency

Automated data flow between sales, inventory, and accounting eliminates redundancy and frees staff for higher-value tasks.

Fewer Errors and Greater Accuracy

Integrated systems minimize the risk of data mismatches, duplicate entries, or manual calculation errors.

Improved Cash Flow Management

By tracking pending insurance reimbursements and rejected claims, pharmacies can take timely actions to recover payments.

Smarter Business Insights

Detailed reports help identify high-profit items, peak sales periods, and underperforming products, supporting better decision-making.

Enhanced Staff Satisfaction

Employees benefit from streamlined processes, clear workflows, and reliable tools that reduce daily stress.

Stronger Relationships with Insurance Providers

Submitting claims that are properly formatted and compliant improves approval rates and reduces payment delays.

Easier Expansion

When opening new branches, a centralized system ensures consistency and simplifies scaling.

5. Why a Specialized Platform Like Juleb Is an Ideal Choice

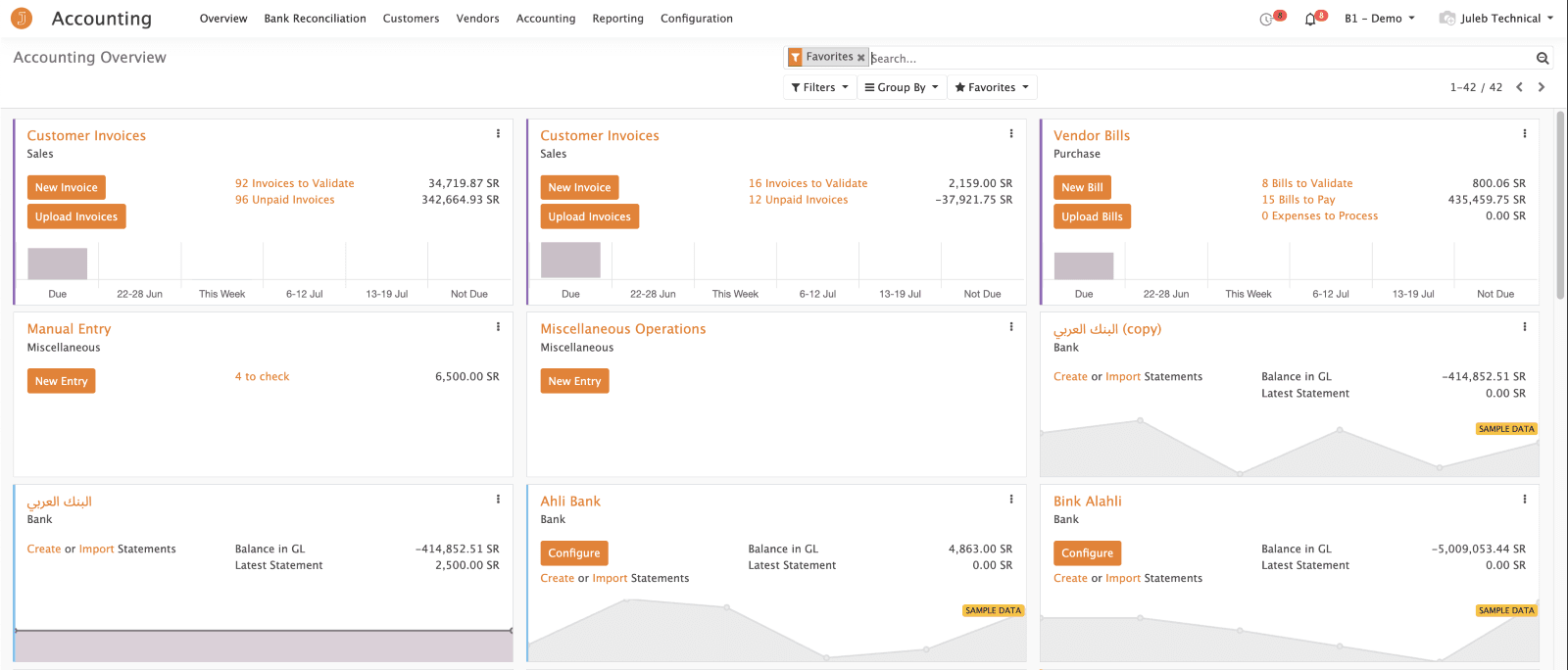

A pharmacy-oriented platform like Juleb stands out for offering an integrated solution that combines point of sale, inventory, accounting, and e-invoicing in a unified dashboard. Key Advantages:

Designed Specifically for Pharmacies

Tailored to pharmacy operations, including prescription management, inventory, and insurance integration.

Offline/Online POS Functionality

The point-of-sale system can work both online and offline, ensuring uninterrupted service.

Fully Integrated Modules

Sales data instantly updates accounting records and inventory, reducing errors and duplication.

Powerful Reporting Tools

Dashboards offer real-time insights and customizable reporting for better decision-making.

Regulatory Compliance Built In

Designed to align with government requirements for e-invoicing and tax reporting.

User-Friendly and Reliable Support

The platform is built with an intuitive interface and supported by a professional team to ensure smooth operation.

Pharmacies interested in improving performance and compliance are encouraged to request a free trial of the platform to experience the benefits firsthand.

Conclusion

Adopting an accounting system compatible with insurance and electronic invoicing is no longer optional for pharmacies seeking to remain competitive, compliant, and efficient. It bridges the gap between operational needs and regulatory obligations while unlocking valuable business insights.

Whether you're managing a single pharmacy or a large chain, a smart system ensures you stay on top of inventory, finance, and insurance claims all while saving time and minimizing risk. A solution like Juleb offers a comprehensive, pharmacy-focused approach to modern challenges. Don't wait schedule your free demo today and explore how digital transformation can elevate your pharmacy’s operations to the next level.