One of the pillars enabling this transformation is adopting a reliable, secure, and regulation‑compliant accounting system. But with so many options—local and global how do you choose accounting software you can truly trust? In this article, we’ll explore:

The specific regulatory environment in Saudi Arabia (especially ZATCA / e‑invoicing requirements)

Key criteria for what makes accounting software “trusted”

Examples of accounting / ERP software trusted in KSA

Why Juleb stands out (with features, compliance, local fit)

How to evaluate and choose

Let’s dive in.

The Regulatory Landscape in Saudi Arabia

ZATCA & E‑Invoicing Compliance

One of the major shifts in the Saudi accounting and taxation ecosystem is the implementation of mandatory e‑invoicing policies under Zakat, Tax and Customs Authority (ZATCA). Businesses must now adopt systems that can issue invoices in approved formats (XML, PDF A‑3, etc.), embed QR codes, assign unique invoice identifiers (UUIDs), and transmit data securely on demand.

To avoid penalties and fines, your accounting software must be ZATCA‑approved or fully compliant with their regulations.

Phase 2 E‑Invoicing & Integration

Saudi Arabia’s e‑invoicing regime is rolling out in phases. In Phase 2, the requirements become stricter: real-time integration, invoicing output transmission, audit traceability, and higher demands for data accuracy. Thus, trusted accounting software must not only issue compliant invoices, but also be capable of real-time connectivity and secure data exchange with government systems.

Other Regulations & Tax Compliance

Beyond e‑invoicing, businesses must also handle:

VAT (Value Added Tax) returns

Zakat obligations

Financial statements within GAAP / IFRS norms (for many medium/large firms)

Regulatory reporting, audits, and tax authority audits

Hence, a trusted accounting solution must support these functions, integrate audit trails, maintain data integrity, and provide reliable reporting.

What Makes Accounting Software "Trusted"?

Given the regulatory demands, a “trusted” accounting solution in Saudi Arabia should meet several critical criteria. Here’s what to look for:

1. Regulatory & Compliance Certification

Explicit approval or certification (or demonstrable compliance) with ZATCA e‑invoicing rules.

Ability to embed QR codes, UUIDs, and submit data on demand.

Audit logs, immutable records, and data integrity protections.

2. Security and Data Protection

Strong encryption (data at rest, in transit)

Role‑based access controls and permissions

Backup, disaster recovery, data replication

Reliable uptime, fault tolerance

3. Localization / Arabic + English Support

Bilingual interface (Arabic, English)

Support for Saudi Riyal (SAR) as base currency

Local tax logic, fiscal calendar alignment

Cultural and regional understanding (e.g. local workflows)

4. Scalability & Integration

Scalability—able to grow from small to mid to large scale

Modular architecture: connect with inventory, POS, procurement, HR/payroll, CRM

Real‑time integration between business modules (so you avoid data silos)

5. Automation & Efficiency

Automated posting of entries (journal, accruals, depreciation)

Bank reconciliation automation

Auto‑generation of recurring invoices

Alerts, workflows, exception handling

6. Real‑Time Reporting & Dashboards

Live dashboards (cash flow, P&L, balance sheet, KPIs)

Branch-level or segment-level reporting if you have multiple units

Drill-down, slicing, filtering, custom views

7. Reliability, Support & Reputation

Vendor track record in Saudi Arabia / GCC

Local support, responsiveness, training

Clients and case studies in the region

Transparent pricing & upgrade path

Why Juleb Is a Trusted Choice in Saudi Arabia

While many options exist, Juleb stands out for bridging local regulatory, industry, and operational needs with a modern cloud accounting platform.

Compliance & ZATCA Approval

Juleb emphasizes that it is ZATCA‑approved / compliant and supports issuance of e‑invoices in required formats (XML, PDF A‑3), QR codes, UUID per invoice, and secure submission to authorities.

Because Juleb was built for markets with strict regulation (e.g. GCC), compliance is baked into the platform.

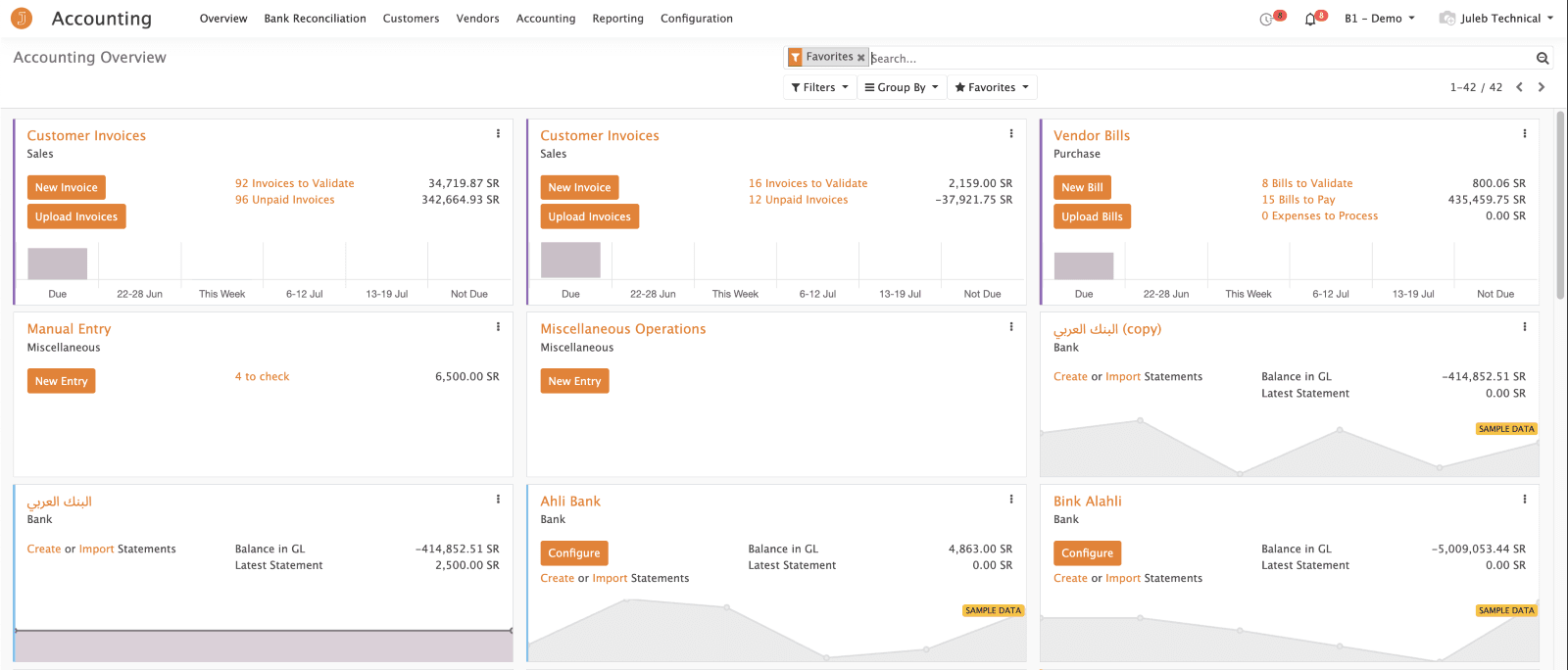

Deep Integration One of Juleb’s key strengths is how it integrates accounting with business operations:

-

Inventory, purchasing, sales, POS modules all sync in real time with financials.

-

That means when you sell a product or record a purchase, the corresponding journal entries, stock adjustments, liabilities, etc., update instantly

-

This avoids data duplication and delays, which are common pain points in traditional setups.

Tailored for Healthcare, Retail & Pharma

Juleb is developed with a spotlight on sectors like pharmacies, clinics, medical distribution, and retail.

Some notable features:

-

Wasfaty claim management (for prescription reimbursements) in Saudi context

-

Branch accounting and consolidated reporting for multi‑location businesses.

-

Real‑time dashboards covering profitability, inventory margins, liabilities, etc.

Automation, Efficiency & Reporting

-

Routine tasks (recurrent invoices, journal entries, accruals, depreciation) can be scheduled and automated.

-

Bank reconciliation with auto matching.

-

Real-time reporting dashboards (P&L, cash flow, balance sheet, partner aging) accessible at any time.

Security, Reliability & Local Support

-

Being cloud-based means updates, backups, and reliability are handled centrally.

-

Juleb’s origin is in serving the healthcare/retail sectors, with understanding of regional norms and practices

-

Local support and knowledge of region‑specific regulations help minimize integration friction.

Flexible Deployment

Juleb can be used as an independent accounting module or as part of a broader ERP suite.

This flexibility helps organizations scale gradually without being forced into a monolithic solution before they’re ready.

Case & Credibility

On Juleb’s site and blogs, there are mention of usage by leading companies and in regulated industries.

Juleb also publishes content on accounting compliance, real-time accounting, and how it transforms financial practice in regulated markets like Saudi Arabia.

Because of all these strengths, Juleb is positioned as a trusted accounting solution for businesses operating in Saudi Arabia, particularly those in retail, pharmaceuticals, and distribution.

How to Evaluate & Choose a Trusted Accounting Software in KSA

If you are in the market to adopt or switch software, here’s a suggested evaluation roadmap:

1. Requirements Gathering & Prioritization

List your must-haves (e.g. e‑invoicing compliance, stock management, multi‑branch support)

Identify your “nice-to-haves” (mobile access, custom dashboards, API)

Forecast future growth (more branches, higher transaction volumes)

2. Regulatory Certification Check

Ask vendors for proof / certification / documentation of ZATCA compliance

Verify whether they support Phase 2 e‑invoicing

Ask about update policy when regulations evolve

3. Demo & Sandbox Use

Ensure you can test the software with your realistic data

Try the invoicing / purchase / reconciliation workflows, and check if integration works smoothly

See how user roles and permissions function

4. Integration & Ecosystem Compatibility

Check integration with other systems you use (POS, CRM, payroll, etc.)

Look for APIs or prebuilt connectors

Ask about data migration from legacy system

5. Security, Backups & Service Level

Review security certifications, encryption, backups, uptime commitments

Ask about disaster recovery, data retention, encryption keys

Confirm service support levels, SLA, support in Arabic & English

- Scalability & Total Cost of Ownership (TCO)

Ensure vendor’s pricing model is clear (licensing, user fees, module fees, support)

Project future cost as you scale

Avoid lock-in traps—ask how data export / exit would work

7. Vendor Reputation & References

Seek case studies in Saudi / GCC

Ask for references among businesses in your sector

Search online reviews, forums, and local user feedback

8. Pilot & Rollout Strategy

Start small (e.g. one branch or department)

Train users early

Monitor issues and iterate

When you follow this structured evaluation, you’ll reduce risk and increase your confidence in choosing a system you can trust over the long term.

Summary & Outlook

To succeed in Saudi Arabia’s regulated environment, having trusted accounting software is no longer optional it is essential. A system that fails to keep up with compliance, security, or integration demands could expose your business to risks, fines, and inefficiencies.

Among the options in the market, Juleb stands out for its compliance-first design, deep integration with operations, real-time capabilities, regional orientation, and sector specialization. For companies in retail, pharma, distribution, or multi-branch settings, Juleb offers a robust platform that helps you manage financials, remain compliant, and scale efficiently.

If you're ready to see how Juleb fits your business, why not try it hands-on?

Book a Free Demo of Juleb Today 🚀

Take the next step toward financial clarity and regulatory confidence. Visit Juleb’s official site and book your free demo now:

In the demo, you’ll see:

-

Real-time dashboards showing cash flow, profit/loss, balance sheet

-

E‑invoicing in compliance with ZATCA

-

Integration of accounting with inventory, sales, purchases

-

Automation in journal entries, bank reconciliation, workflows

-

Branch-level consolidation and reporting

-

Security, backups, audit trails, and user access controls